Money, Paradoxes and Partnerships: How Landlocked Countries Can Achieve Sustainable Development

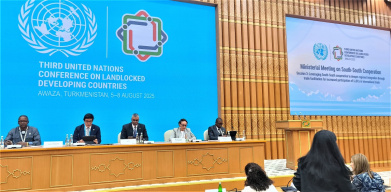

08.08.2025 | 00:35 |In Avaza, within the framework of the Third UN Conference on Landlocked Developing Countries (LLDC), the final round table was held to discuss financing and global partnership as key conditions for achieving sustainable development. The main conclusion of the speakers: without effective investments and solving the debt problem, it will be difficult for these countries to move forward.

A global approach to financing is needed

Deputy Chairman of the Cabinet of Ministers of Turkmenistan Khodjamyrat Geldimyradov, opening the meeting as its co-chair, emphasized that global challenges today exceed the capabilities of any state.

He recalled that the Vienna Programme of Action identified a number of key problems faced by landlocked developing countries, including limited mobilization of domestic resources, a reduction in the distribution of official development assistance, stagnation of export revenues, high levels of debt and uneven flows of remittances with high transaction costs.

“Only a global approach to financing,” he stressed, “can ensure that landlocked countries have access to much-needed resources to achieve sustainable development. This is reflected in both the Avaza Action Program and the Seville Commitment, which underline the importance of delivering on commitments to support the full implementation of the 2030 Agenda for Sustainable Development.”

The speaker stressed that a strong commitment to multilateralism, international cooperation and global solidarity is needed to address these challenges.

Co-chair of the roundtable, Deputy Foreign Minister of Portugal Ana Isabel Xavier, agreed that finance plays a central role. She noted that partnerships should be more inclusive and suggested using instruments that link debt resolution to climate goals. This would free up budget funds for projects that really matter.

The paradox of the ‘mountain kingdom’

Foreign Minister of Lesotho Leyone Mpotyoane vividly described the paradoxical situation facing many LLDCs. His country is rich in water resources, but its mountainous terrain poses serious obstacles to infrastructure and agricultural development. He stressed that Lesotho has huge potential for renewable energy and a young population, but suffers from energy shortages and a ‘brain drain’.

The main reason for this, he said, was unsustainable foreign debt, which was spending money on interest payments rather than on building schools, hospitals and roads. He called for a reform of the international financial system that would provide debt relief and affordable financing.

Migrant money and investing in youth

Among other important sources of funding, participants highlighted:

Migrant remittances: Per Liliert, Director of the International Organization for Migration (IOM), noted that migrants send home more than $700 billion annually. These funds can not only help families, but also become a source of funding for small businesses if high transfer fees are reduced.

Foreign Investment and Trade: Trudy Hartzenberg, a representative of the Trade Law Center for Southern Africa, emphasized that foreign direct investment can help African countries move away from exporting raw materials to creating finished goods, which in turn will ensure the development of jobs and the economy.

Youth: The representative of Uzbekistan noted that the stable growth of the youth population in Central Asia provides “demographic dividends.” Investments in education and support for youth will allow these countries to adapt more quickly to innovations and new conditions.

Overall, the participants of the round table agreed that the success of the Avaza Action Program directly depends on how effectively the world community can combine efforts to solve the financial and debt problems of LLDCs. This requires a revision of old approaches and the development of new, fairer cooperation mechanisms that take into account the specifics of each country.

ORIENT